Latest News

Kristi Noem just tore apart Biden’s immigration legacy with this explosive announcement

The Biden-Harris administration turned America’s southern border into a revolving door for illegal aliens. Now Trump’s team is…

July 16, 2025

Lara Trump made one daring move that has the Trump administration scrambling

President Trump’s inner circle is supposed to be on the same page. But family members don’t always follow…

July 15, 2025

All hell broke loose when Tulsi Gabbard dropped this terrifying deep state secret

The deep state has been fighting President Trump every step of the way since he took office. Now…

July 15, 2025

Donald Trump discovered one terrible secret that has his own officials fuming

The Trump administration is dealing with a major internal crisis. Top officials are speaking out about a massive…

July 15, 2025

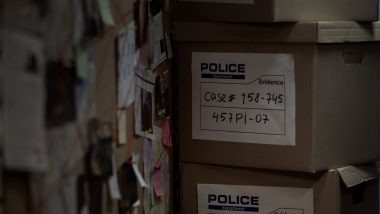

Pam Bondi Got Caught in One Scandal That Has Kash Patel and Dan Bongino Calling for Her Head

Attorney General Pam Bondi promised the American people transparency on Jeffrey Epstein. She delivered a complete mess instead.…

July 14, 2025

Barack and Michelle Obama inked one Hollywood deal that will make you sick

The Obamas are back to their old tricks in Tinseltown. They thought they could slip this one past…

July 14, 2025

Donald Trump utterly destroyed union bosses with one executive order that has them in total panic

Federal union bosses thought they had a stranglehold on the government workforce. But they never saw this coming.…

July 14, 2025

The Washington Post was utterly humiliated after using this clown to attack Trump

The Washington Post has completely lost its mind. Jeff Bezos can’t save this sinking ship from itself. And…

July 14, 2025

Marsha Blackburn asked one scary question that left the Secret Service sweating bullets

The Secret Service has been dodging accountability for months. But one Tennessee Senator wasn’t going to let them…

July 13, 2025

Steve Bannon utterly destroyed the deep state with one demand that left Washington D.C. in chaos

The swamp creatures in Washington, D.C. thought they could bury the Jeffrey Epstein scandal forever. They were dead…

July 13, 2025